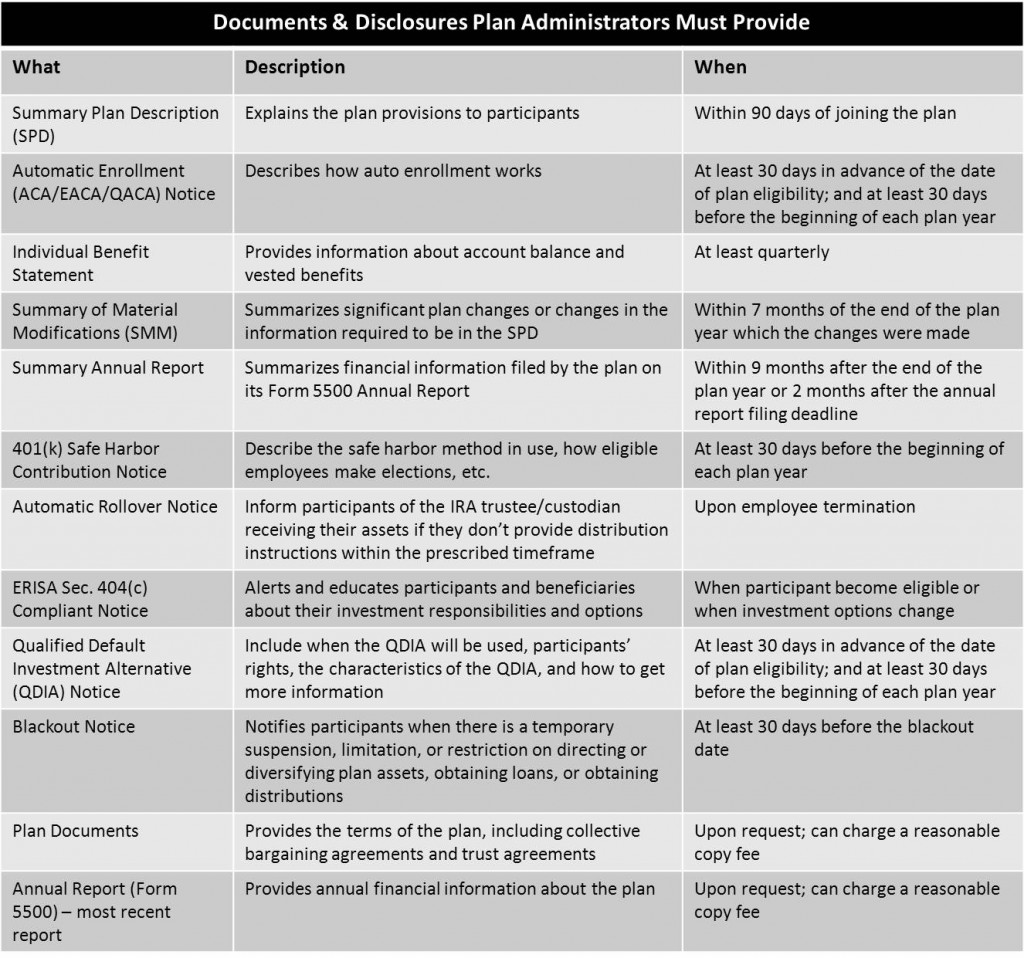

Each retirement plan is required to have a formal, written plan document that details how it operates and its requirements. In addition, Retirement plans are required to provide numerous disclosures to plan participants and other individuals who maintain a balance in your plan. It is important to note that terminated participants, if they still carry a balance in your plan, should receive all notices.

These required notices contain the plan’s provisions written in easy to understand language. Your Third Party Administrator (TPA) should provide you with these required notices in a format that you can easily distribute.

Notice Requirements

Requirements for Electronic Delivery of ERISA Disclosures

Providing all of these disclosures to participants in paper form can be very expensive for plans due to printing and mailing costs. A less expensive alternative is to provide this information to individuals electronically, such as through email or by posting the information on the company’s website.

However, participants can only be provided with information about their retirement plans electronically under limited circumstances. Information can only be distributed in this way to: (1) participants who access documents electronically as an integral part of their job duties; or (2) participants, beneficiaries or other persons who affirmatively consent.

If email is not an integral part of your of your participants job duties, what should you do in order to obtain consent to send plan notices via email? You can (1) have participants confirm their consent by simply clicking a link in a confirming e-mail you and save those email responses; or (2) create a paper form where all participants sign acknowledging their consent (obtain their consent during new hire orientation or when you are reviewing benefits).